Another One From the Lab: ES Mean Reversion Strategy — 1000% Return on Risk, 1.72 Profit Factor (Code Inside)

Built on ES’s Natural Mean-Reverting Behaviour — Full Code Included

Before we dive in — a quick note for subscribers.

You’ve probably noticed that most of the strategies I’ve released so far are built on daily data.

That’s intentional.

I’m focused on picking the low-hanging fruit first — higher-timeframe systems that exploit clear, structural market tendencies.

After years of doing this, I’ve learned that fast doesn’t always mean better.

There’s plenty of edge in intraday systems — and those will come later —

but every portfolio needs a solid foundation first.

And few markets offer better structure to build on than the S&P 500.

🧭 Phase 1 — Understanding the Market

Every system I publish begins with a deep behavioural study in Edge Lab, my internal framework for uncovering directional and behavioural tendencies before I ever touch code.

When I ran ES through it, the results were clear:

ES has a natural long bias.

It’s not a breakout market — it’s a mean-reverting one.

Short holding periods consistently outperform.

That behaviour defines its edge — buying weakness when the market stretches too far, then reverts to balance.

🧠 How I Landed on This Strategy

Once I confirmed ES was mean-reverting, I started searching for a clean way to trade that behaviour.

I ran a series of structured tests — different ways the market could express exhaustion and recovery.

Most approaches worked in parts, but one theme kept showing up: short-term exhaustion followed by a quick stabilisation window.

That became the core of the build — fade the exhaustion, confirm the slowdown, and let the market revert to its mean.

It’s simple, data-driven, and true to ES’s personality.

⚙️ Phase 2 — From Edge to Structure

The structure is simple:

Entry — Detects short-term exhaustion and fading momentum.

Confirmation — Ensures the move is stabilising before committing.

Execution — Uses a limit order near prior structure for efficient fills.

Exit — Time-based, closing after a fixed number of bars.

No forecasting. No over-optimisation. Just systematic mean reversion aligned with the market’s core rhythm.

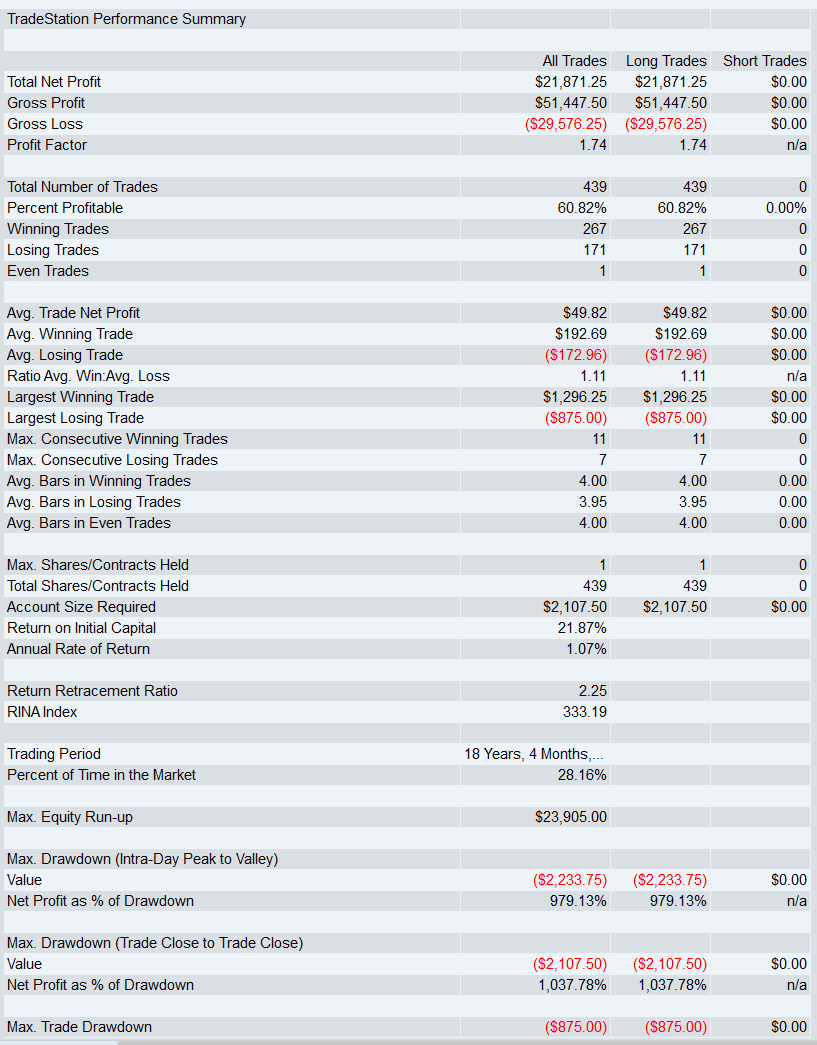

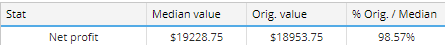

Here is the results:

Here is the results if you wanted to trade the Micro contract:

Phase 3 — Robustness Testing

Before adding any stop logic, I test the raw strategy’s structure.

The goal: ensure the core edge holds up under randomisation, skips, and parameter shifts.

I won’t show every test here (those remain proprietary), but below are several examples that demonstrate structural robustness.

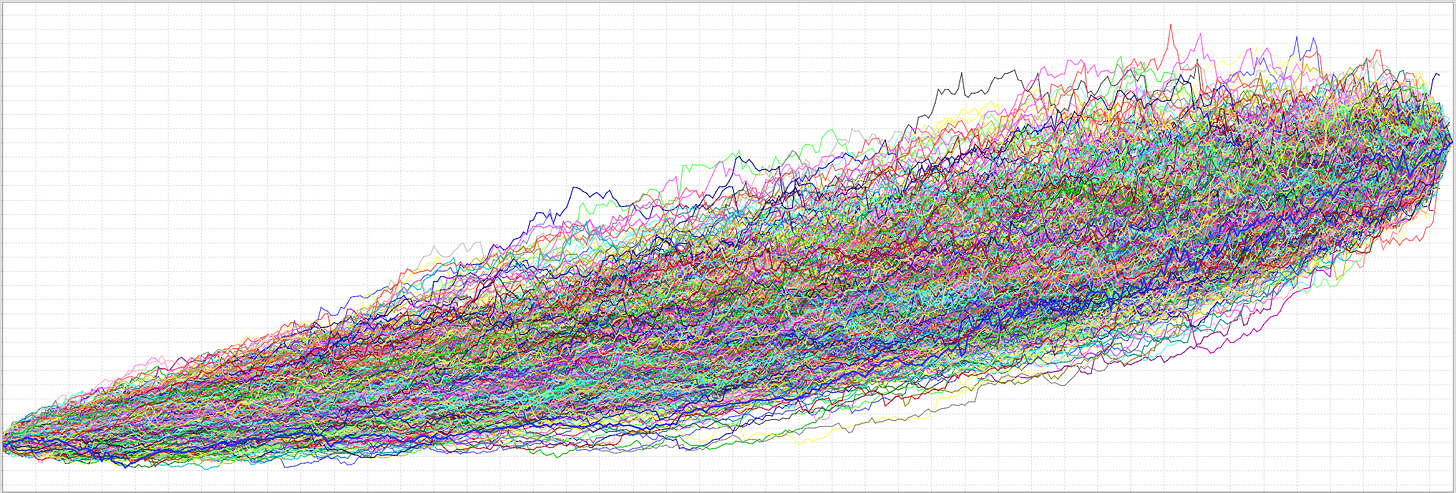

🔹 Monte carlo Skip/Randomisation Test

Tests the system by skipping random trades to simulate execution variance.

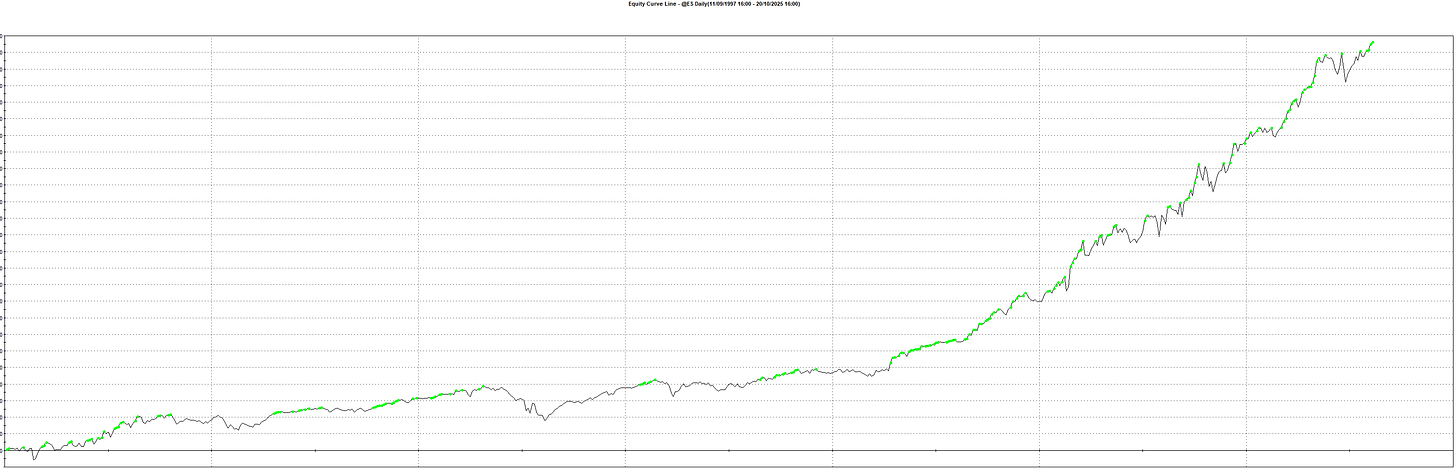

🔹 Extended OOS Equity (1998 onward)

Tests long-term durability across multiple volatility regimes.

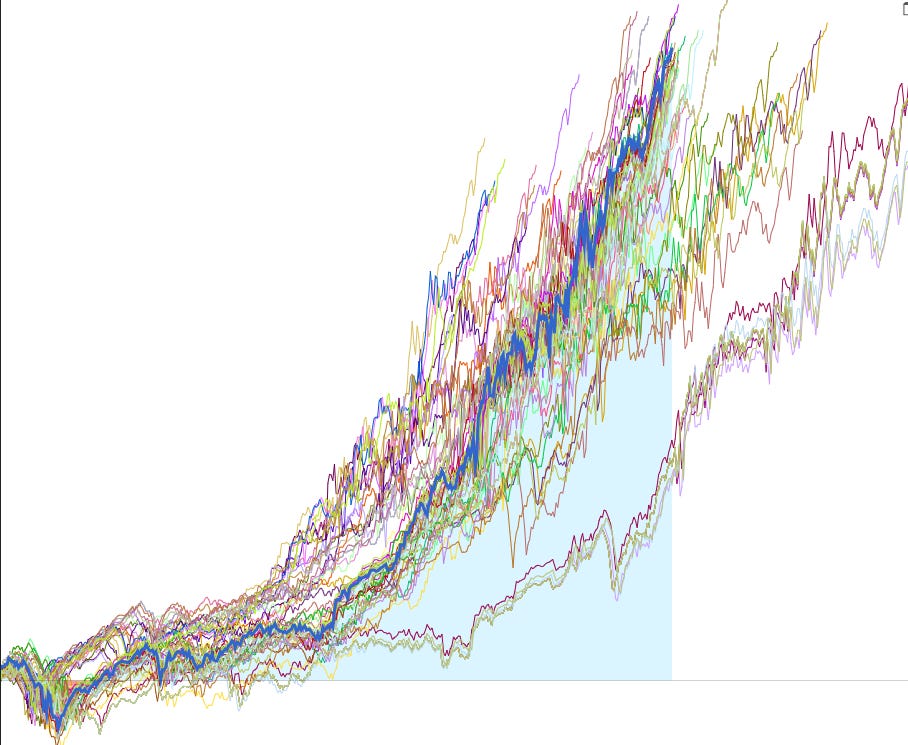

🔹 Parameter Sensitivity

Shows whether performance forms stable plateaus or isolated peaks — we want plateaus.

🔹 Parameter Extremes

Pushes parameter inputs to extremes to see if the strategy falls apart

🔹 System Parameter Permutation Test

Runs thousands of parameter combinations to ensure the deployed version sits near the median, not a lucky outlier.

🔹 Walk-Forward Matrix (WFM)

Rotates in-sample / out-of-sample windows to test adaptability over time.

The consistency across all robustness layers confirms the system’s stability — it’s not curve-fit, it’s structural.

Phase 4 — MAE Analysis and Stop Logic

Once robustness is confirmed, I apply Maximum Adverse Excursion (MAE) analysis to set a protective stop.

This step is about risk control, not optimisation.

By analysing historical trades, I pinpointed the threshold where normal drawdown transitions into genuine structural failure.

That’s where the stop sits — a safety mechanism that protects capital without breaking the edge.

The result: smoother equity, lower tail risk, and minimal impact on profitability.

💻 Full Strategy Code

Below is the complete code for the ES Mean Reversion Strategy — clean, fully commented, and ready to drop into your platform.

Keep reading with a 7-day free trial

Subscribe to Alpha Algo Trading Research to keep reading this post and get 7 days of free access to the full post archives.